M&A (mergers and acquisitions) should proceed in a way that increases the value of a company to the shareholders.

How to calculate synergies in M&A

A corporate merger is a combination of assets and liabilities of two firms that form a single business entity. When the senior management decides to buy another company, it is mostly focused on increasing the value of a new company.

The synergy effect is expected to be the core driver to improve sales, profit margins and the market positioning of the company. Excluding any synergies resulting from the merger, the total post-merger value of the two firms is equal to the pre-merger value.

Nevertheless, synergies do exist.

Often the value creation is the motive for an acquisition. And it can result in several ways from the transaction’s synergy.

Value creation through M&A

Value can be created, for example, through revenue enhancement, cost reductions, increased operating cash flow, improved managerial decision making, or the sale of redundant assets. However, the value created from proposed synergies also may have an additional investment cost as well.

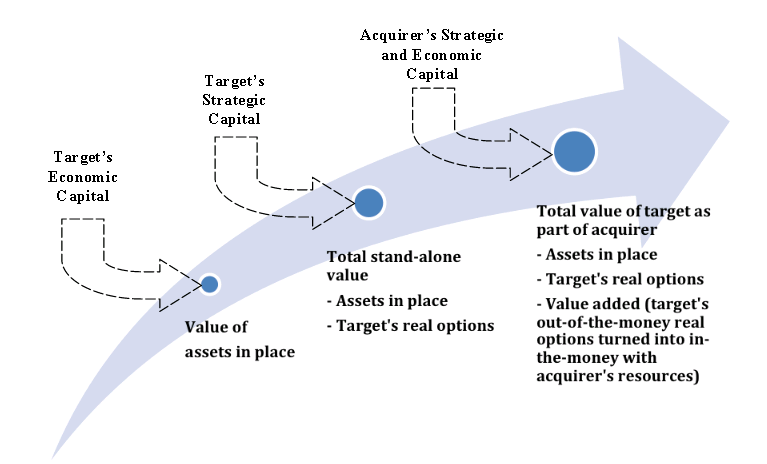

Acquisition target‘s total value is comprised of the assets in place and the value of merging companies’ combined with real options.

In other words, a buying company that views synergies as real options can profit from acquisitions even though it paid a premium over the market price.

Post-acquisition strategic real options are considered as the value adding real options (which we defined broadly as synergies) that are unlikely fully priced in the market because they can be exclusively available only for a specific acquiring company.

Synergy takes the form of revenue enhancement and cost savings.

When two companies in the same industry merge, such as two banks, combined revenues tend to decline to the extent that the businesses overlap in the same market and some customers become alienated.

For the merger to benefit shareholders, there should be cost-saving opportunities to offset the revenue decline. In other terms, the synergies deriving from the merger must exceed the initially lost value.

As a rule of thumb, synergy is a business combination where 2+2 = 5. Or here is another way we can calculate synergies in M&A:

Synergy = NPV (Net Present Value) + P (premium),

where:

NPV – net present value of a newly created company.

Synergy benefits can come from four potential sources:

- Revenue increase. This can be done by selling more different goods and services using a broadened product distribution. This will help the new company to compete for customers which originally were not the clients.

- Expenses reduction. Because of a merger or acquisition, many companies optimize internal positions and introduce more responsibilities to the existing roles.

- Process optimization. It is done by introducing enhanced marketing tactics and strategies, branding, better technologies, and more effective distribution.

- Financial economy. United enterprise from the legal prospective can get better tax benefits, state support etc. But the buyers should remember: financial economy alone can’t optimize the strategic position of a company. So it should not be the only value driver in the deal.

To calculate synergies in M&A, the evaluation should be focused on three parameters:

- Benefit impact from synergy effect. This basically means that each forecast component should be critically reviewed. However, consultants tend to make overly-optimistic cash flows and costs.

- The probability of achieving. Here we can consider three scenarios: optimistic, pessimistic and the realistic for achieving. The Monte-Carlo simulation method helps with finding the range of possible results.

- Time of benefit generation. History of M&A deals has a lot of cases when speeding up with a purpose of increasing acquisition attractiveness lead to overestimated synergy value. Doing this M&A team cheat on themselves.

These parameters can have a huge impact on the accuracy of the synergy evaluation.

When synergies are considered?

M&A professionals often solely focus on the benefits of synergies during a pricing analysis for an acquisition.

However, acquirers often must make incremental investments before realizing the return on capital generated by synergies.

Many analysts, however, do not consider these incremental investments or “hidden” costs when performing a pricing analysis or valuation of a potential target. Failure to consider the hidden costs often causes the overvaluation of a potential target, which may lead to destroying value rather than creating it.

Synergy appeared due to acquisition should include higher results then it was originally expected.

Acquisition process should be well-planned. Mark Sirower, the US leader of the Merger & Acquisition Strategy and Commercial Diligence practice, named 4 components which should take place in order to achieve successful synergies:

- Strategic vision

- Operating strategy

- Systems integration

- Power and culture

The buyer should pay out the premium to shareholders of merged company. The higher the premium, the lower the potential benefit for the buyer. Therefore, synergies should not be intangible. It should be carefully forecast and discounted from net cash flows which are feasible within the chosen time frame.

Post-merger integration issues, as well as competitors’ reactions, can contribute to the hidden costs of an acquisition.

Besides the positive impact of revenue enhancements, cost reductions, and other efficiencies, valuation analysts need to price them in, too.

How do you find the article? Was it helpful? Let me know what you think in the comments below.

For more finance tips, subscribe to our weekly newsletter and follow us on Twitter, Facebook, Instagram and LinkedIn.