3 strategies to help you get into investment banking

Investment banking is known as one of the toughest jobs to land after college. It’s notorious for long hours and the wear-and-tear it puts on first-year analysts.

Still, it’s also known to be extremely difficult to get into because of the high demand. Why?

The sky-high pay of course.

First-year investment bankers can easily net six figures after their bonus at some of the large bulge-bracket banks. Within a few years, total compensation can skyrocket to upwards of $500,000.

The competition can be brutal, though. You’ll be competing against students from some of the top ivy-league schools who can be very intelligent and well-connected.

So how can you stand out and best position yourself to become an investment banker?

Try using these three tricks below:

1. Use relevant experience to get into investment banking

What’s the most important thing to have on your resume when applying for investment banking analyst jobs?

Not your school. Not your GPA. Relevant experience.

Investment banks want to see that you have relevant experience doing the type of work and tasks they’ll expect you to do on the job. Things like financial modeling, financial analysis, mergers and acquisitions work, valuation, etc.

Having that real-world experience is what will separate you from the competition.

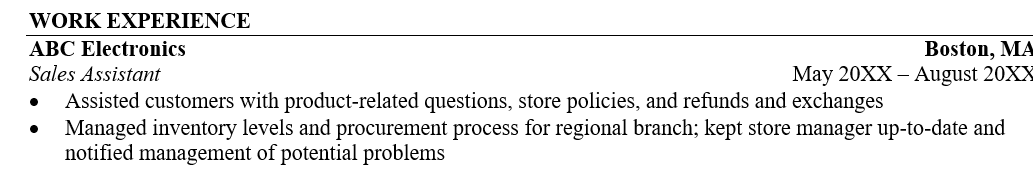

So while investment banks don’t care about your old sales job like this:

They love to see relevant experience like this:

Investment banks would much rather hire someone that they know can start working from day one versus someone that would require weeks of training.

This guide on how to become an investment banker lists a bunch of creative ways to get this type of experience.

2. Network, network, network

What’s the most effective way to break into any job you want?

Networking.

This is especially true with investment banking. Bulge bracket investment banks receive tens of thousands of resumes per year.

Normally, you’ll apply online and have your resume run through resume scanning software. If you’re lucky enough, your resume will make it through the scanner and get into the hands of someone in the HR department.

If you’re really lucky, your resume will make it past HR and get in the hands of someone in the investment bank that can actually impact whether or not you get hired.

It’s a long, brutal process, and your odds of making it through all of that are slim to none.

Now, what if you had a great conversation with someone high up in the investment bank (VP or Managing Director) that passed your resume along to HR and told them to bring you in for an interview?

That’s much more effective!

Even if you don’t have the best background, networking is always the easiest way to become an investment banker.

University students looking to get an investment banking job should really be spending the majority of their time networking with people in the industry who actually influence whether or not they can break in.

3. The ‘Spin and Bankify’ trick

So let’s say you’re late to the game and don’t have any relevant experience to add to your resume. What can you do?

Utilize the ‘spin and bankify’ trick.

Essentially, you need to exaggerate a little and make your resume seem as analytical and banking-based as possible, using specific examples and results.

So, you want to:

- ‘Spin and bankify’ your previous experience to make it sound more analytical and financial based

- Utilize specific examples

- Highlight results

Take a look at this example:

Software Development Intern, Cell Phone Company

- Developed cell phone applications for collecting demographics and user/revenue data in a team of 3 and investigated new web technologies.

- Presented findings to CEO.

Boring, right?

That just tells an employer you did absolutely nothing banking- or even finance-related over summer.

Now let’s use the ‘spin and bankify’ trick:

Technology Consultant, Cell Phone Company

- Recommended development budget of $150,000 to CEO, based on analysis of ROI on similar projects in the past.

- Worked in team of 3 to design applications for analyzing demographic data; optimized revenue per user for mobile software and made recommendations that led to 25% higher RPU.

Why is this better?

- The Title – “Technology Consultant” sounds more related to finance than “Software Development Intern”

- Recommendations and Analysis – You recommended specific numbers here and analyzed the financial returns of previous projects – just like what you do in real finance.

- Results – At the end you have a tangible, monetary result: a 20% higher revenue-per-user number.

Conclusion

Learning how to become an investment banker and execute on those tasks isn’t easy.

It often takes much more work than trying to get any other typical corporate finance job. Even if you don’t come from an ivy-league university or don’t have the best GPA, though, it’s still possible.

Get some relevant experience, network hard, and you’ll have no problem finding a way to get into investment banking.

What do you think? How did you find your way in investment banking?

I would love to hear your experiences! Just leave your thoughts in the comments below.

For more business tips, check our entrepreneurship section, subscribe to our weekly newsletters.