What the latest readings from my bubble gauge say about the market?

As you know, I like to convert my intuitive thinking into indicators that I write down as decision rules (principles) that can be back-tested and automated to put together with other principles and bets created the same way to make up a portfolio of alpha bets.

I have one of these for bubbles.

Having been through many bubbles over my 50+ years of investing, about 10 years ago I described what, in my mind, makes a bubble, and I use that to identify them in markets — all markets, not just stocks.

I define a bubble market as one that has a combination of the following in high degrees:

- High prices relative to traditional measures of value (e.g., by taking the present value of their cash flows for the duration of the asset and comparing it with their interest rates).

- Unsustainable conditions (e.g., extrapolating past revenue and earnings growth rates late in the cycle when capacity limits mean that growth can’t be sustained).

- Many new and naïve buyers who were attracted because the market has gone up a lot, so it’s perceived as a hot market.

- Broad bullish sentiment.

- A high percentage of purchases are financed by debt.

- A lot of forward and speculative purchases are made to bet on price gains (e.g., inventories that are more than needed, contracted forward purchases, etc.).

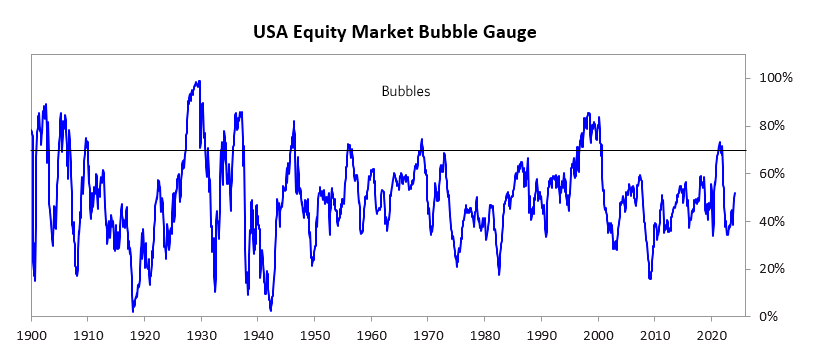

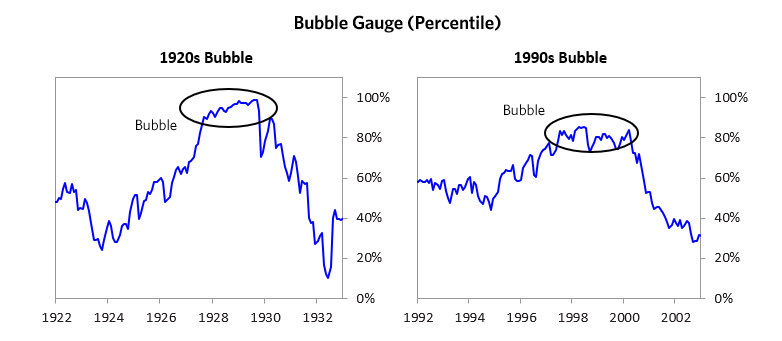

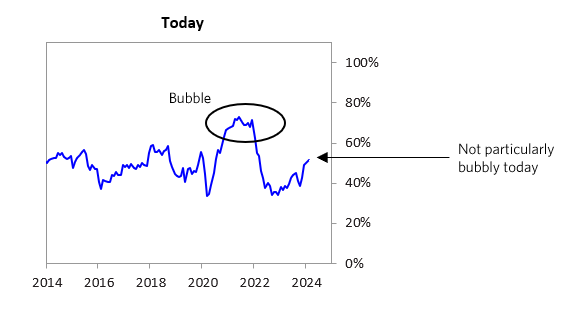

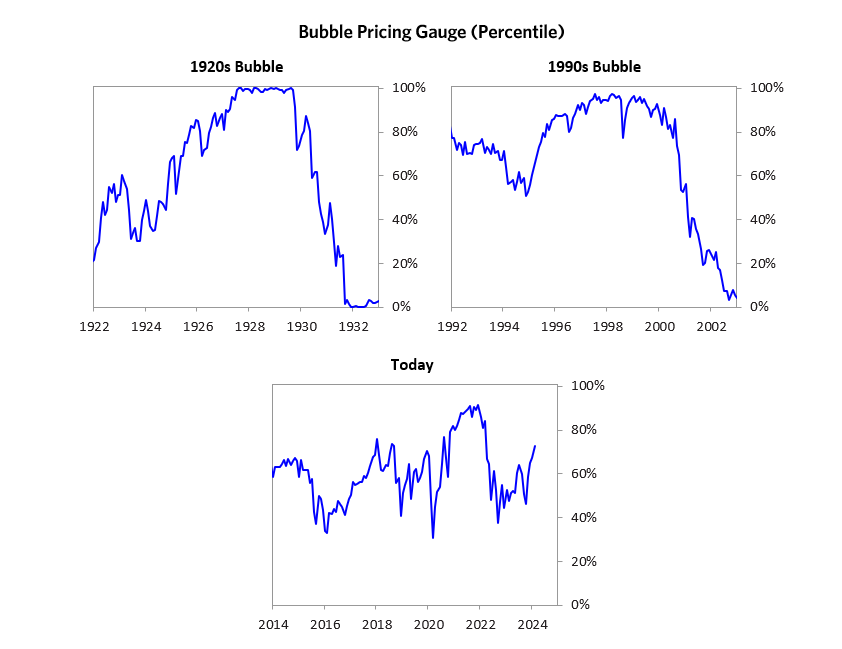

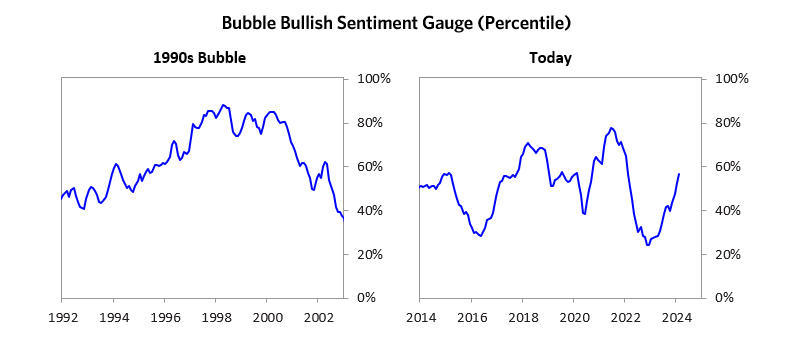

I apply these criteria to all markets to see if they’re in bubbles. When I look at the US stock market using these criteria (see the chart below), it — and even some of the parts that have rallied the most and gotten media attention — doesn’t look very bubbly. The market as a whole is in mid-range (52nd percentile). As shown in the charts, these levels are not consistent with past bubbles.

The “Magnificent 7” has driven a meaningful share of the gains in US equities over the past year. The market cap of the basket has increased by over 80% since January 2023, and these companies now constitute over 25% of the S&P 500 market cap. The Mag-7 is measured to be a bit frothy but not in a full-on bubble.

Valuations are slightly expensive given current and projected earnings, sentiment is bullish, but doesn’t look excessively so, and we do not see excessive leverage or a flood of new and naïve buyers. That said, one could still imagine a significant correction in these names if generative AI does not live up to the priced-in impact.

In the remainder of this post, I’ll walk through each of the pieces of the bubble gauge for the US stock market as a whole and show you how recent conditions compare to historical bubbles. While I won’t show you exactly how this indicator is constructed, because that is proprietary, I will show you some of the sub-aggregate readings and some indicators.

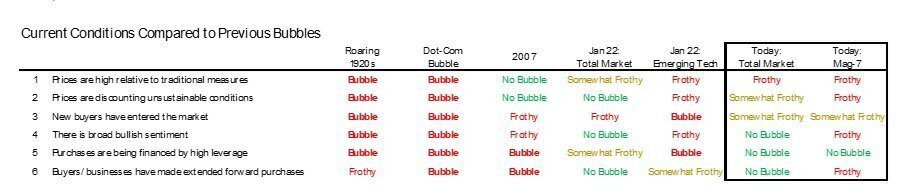

Each of these six influences is measured using a number of stats that are combined into gauges. The table below shows the current readings of each of these gauges for the US equity market. It shows how the conditions stack up today for US equities in relation to past times. Our readings suggest that, while equities may have rallied meaningfully, we’re unlikely to be in a bubble.

For the Mag-7, some of our readings look frothy, but we do not see bubbly conditions in aggregate. We have somewhat lower confidence in this determination because we don’t have a high-confidence read on how impactful generative AI will turn out to be, and that is a significant influence on the expected cash flows of many of these companies.

The next few sections go through each of these sub-gauges in more detail.

1. How High Are Prices Relative to Traditional Measures?

The current read on this price gauge for US equities is around the 73rd percentile.

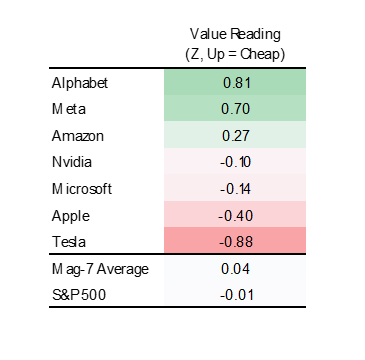

Looking at the Mag-7, we are reading Alphabet and Meta as somewhat cheap, and Tesla as somewhat expensive. We’d call the group in aggregate fairly priced.

This value read is partly based on analyst expectations for growth, so we are assuming that analysts are making reasonable predictions for growth driven by generative AI. This is an area where we have lower confidence because there is so much inherent uncertainty and because it is not our area of expertise.

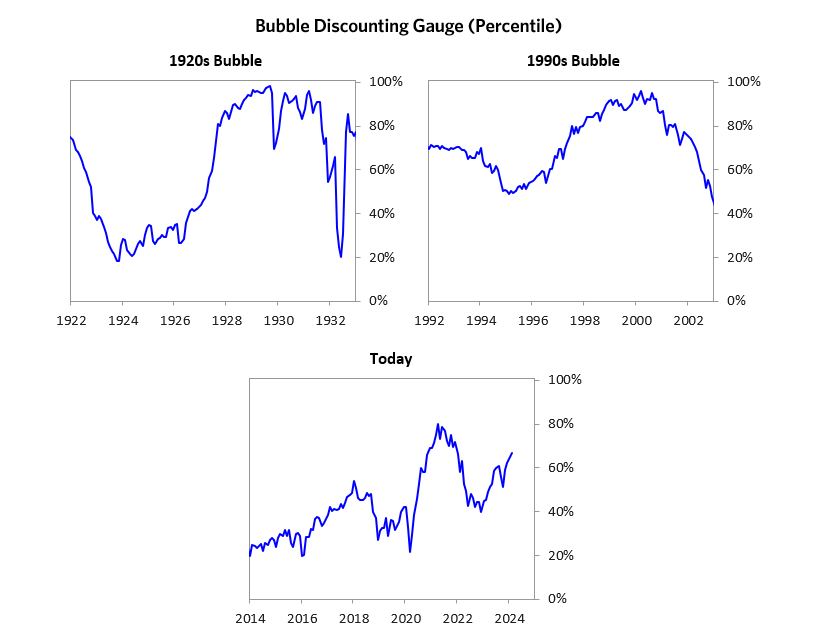

2. Are Prices Discounting Unsustainable Conditions?

This measure calculates the earnings growth rate that is required to produce equity returns in excess of bond returns. This is derived by looking at individual securities and adding up their readings. Currently, this indicator is just around the 67th percentile for the aggregate market — more elevated than some of our other readings. The earnings growth discounted in stocks is still a bit high.

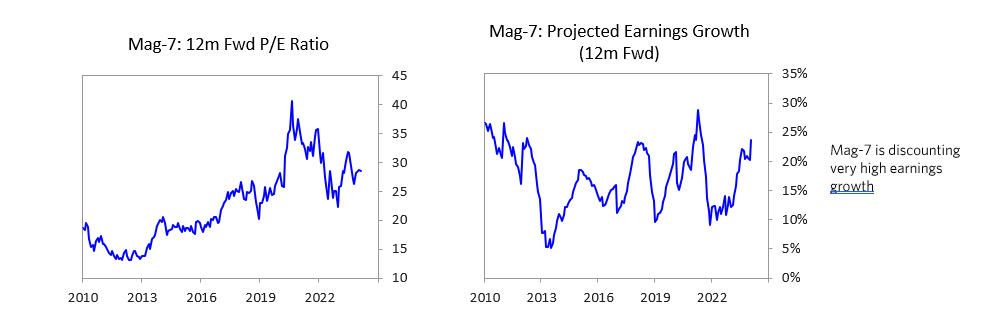

The Mag-7 looks frothy by this measure, but not bubbly. P/Es have come in from their COVID highs but are still elevated relative to history. And these P/Es are baking in fairly high projected earnings growth, which is driven by expectations around AI for many of these companies.

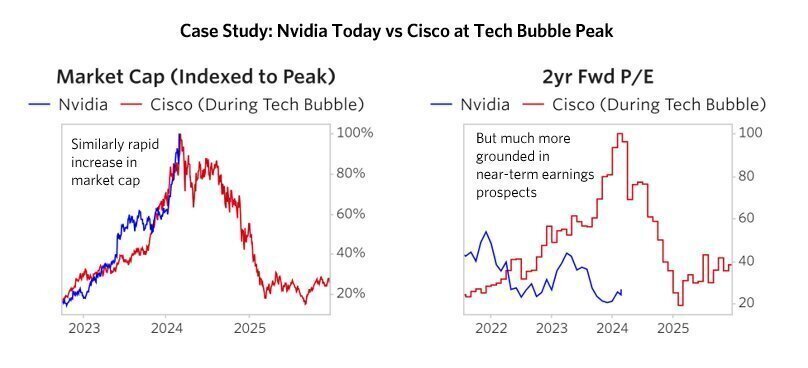

We find the comparison to the tech bubble helpful for explaining why we do not see a bubble today. We can look for instance at Nvidia today versus Cisco during the tech bubble. The two cases have seen similar share price trajectory. However, the path of cash flows has been quite different. Nvidia’s two-year forward P/E is around 27 today, reflecting that, even as the market cap has grown ~10x, earnings have also grown significantly and are expected to continue to grow over the next year or two because of actual orders that we can validate. During the tech bubble, Cisco’s two-year forward P/E hit 100. The market was pricing in far more speculative/long-term growth than we see today.

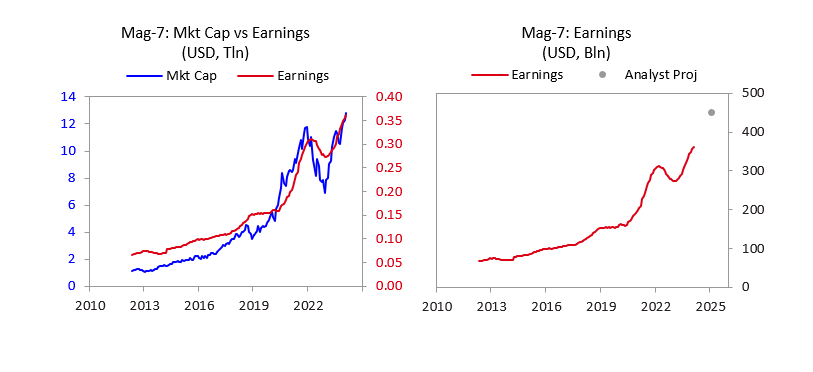

As you can see in the charts below, this is true of the broader Mag-7 as well; over the last couple of years, the market cap of these companies has grown by and large in line with earnings (which have increased rapidly).

3. How Many New Buyers (i.e., Those Who Weren’t Previously in the Market) Have Entered the Market?

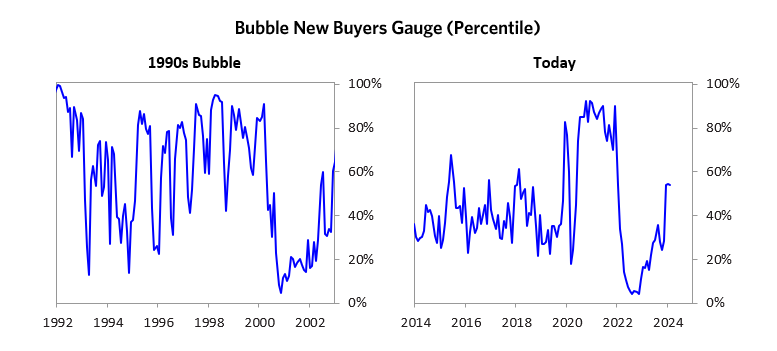

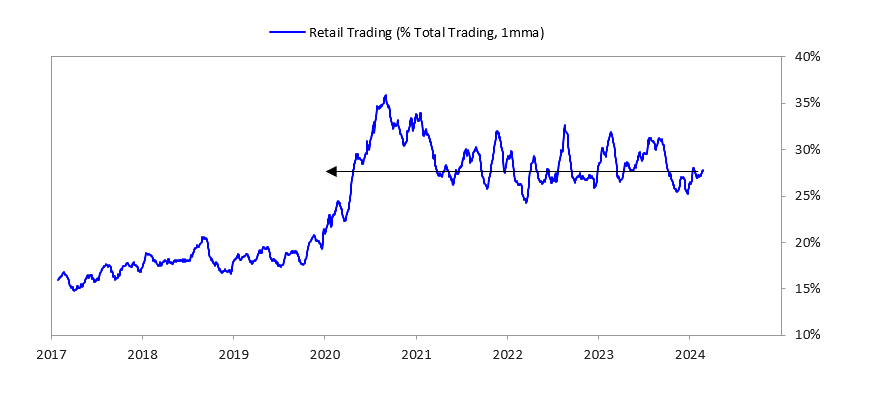

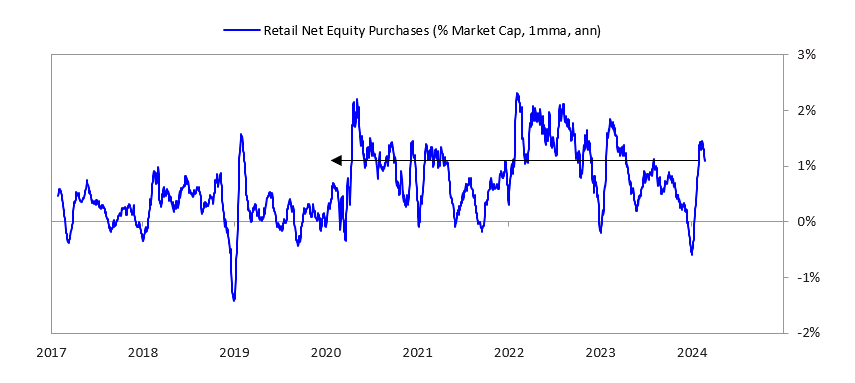

A rush of new entrants attracted by rising prices is often indicative of a bubble. This was the case in the 1990s equity bubble and in the 1920s bubble, based on accounts of the time (though, regrettably, our data doesn’t go back that far for this gauge and some of the gauges we’ll show next). This gauge shot above the 90th percentile in 2020 due to the flood of new retail investors into the most popular stocks, which by other measures appeared to be in a bubble. Today, the activity of new buyers is a bit higher than typical—55th percentile—but not particularly concerning.

Retail players continue to be active in the market, but their level of activity has come off COVID-era highs.

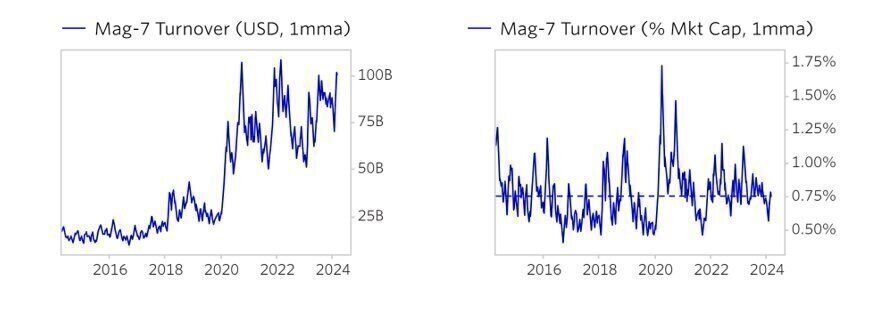

Trading in the Mag-7 (based on turnover) remains near all-time highs in dollar terms, but as a share of the total market cap, it doesn’t look like a speculative frenzy (unlike the high levels of activity seen during COVID).

4. How Broadly Bullish Is Sentiment?

The more bullish the sentiment, the more people have already invested, so they are likely to have fewer resources to keep investing and are more likely to sell. Sentiment in the market is now neutral to slightly positive — not in bubble territory.

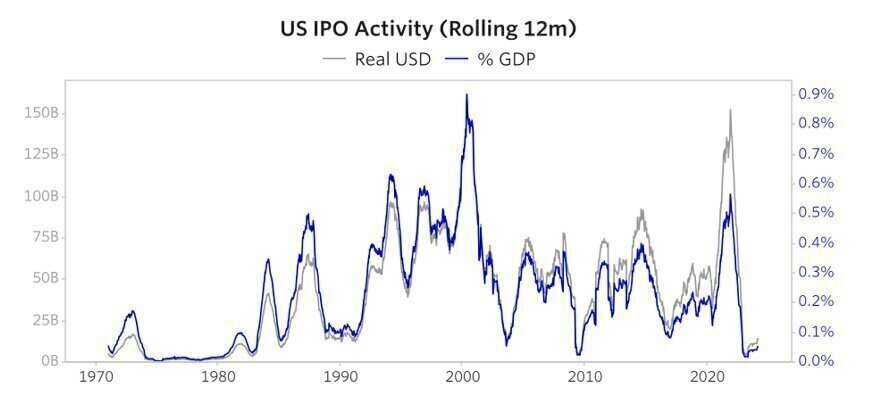

IPO activity, which is a useful data point for equity market sentiment conditions, had been running at extreme highs leading into 2022, as a boom in SPACs and strong equity market conditions drove rapid share issuance. This has meaningfully reversed, with little to no IPO activity more recently.

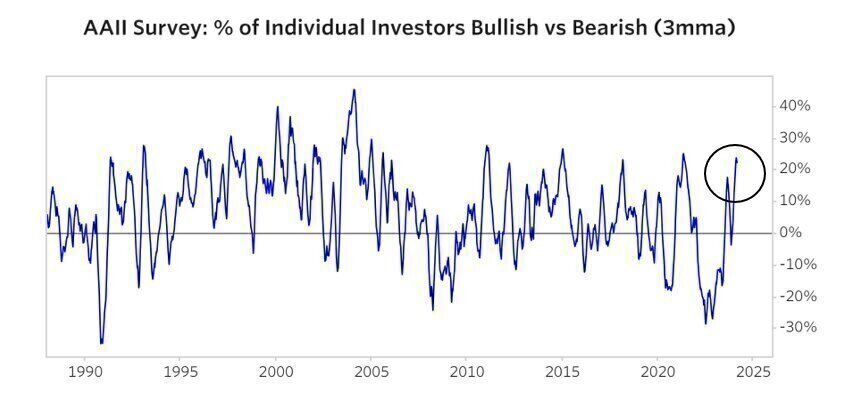

Below, we show surveyed sentiment of retail investors — you can see how this fell meaningfully around 2022 as the Fed tightened and has looked more bullish recently.

Sentiment around AI is quite bullish. You can see below that more than a third of recent earnings calls have included mentions of AI.

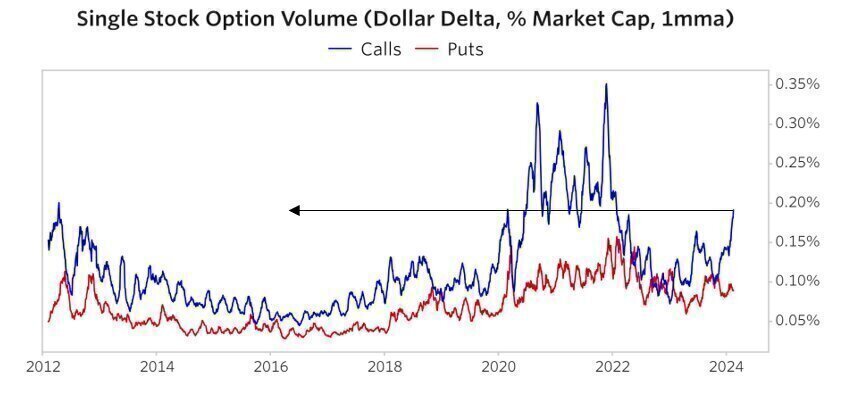

Another way we can get a sense of speculative activity is by looking at the options market—we can see that options activity reached all-time highs during the 2022 bubble and is modestly elevated today.

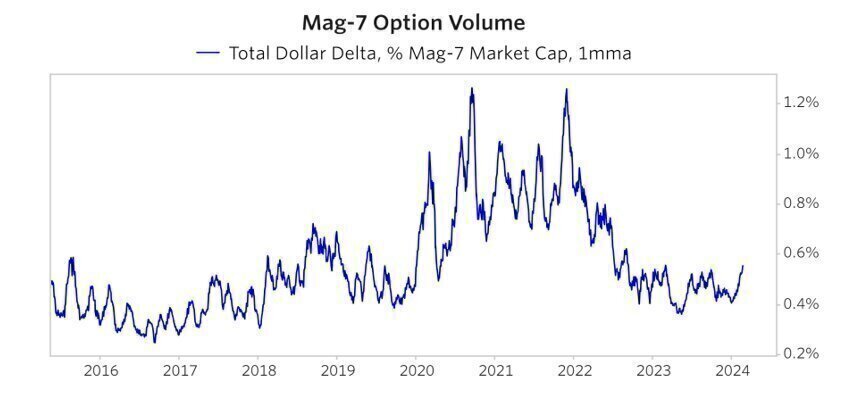

Options activity in the Mag-7 does not look especially elevated.

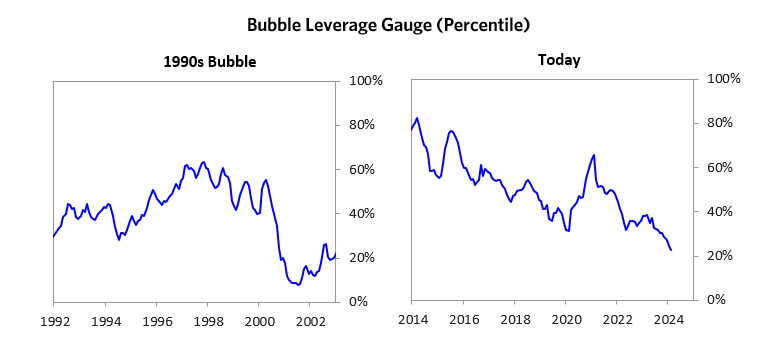

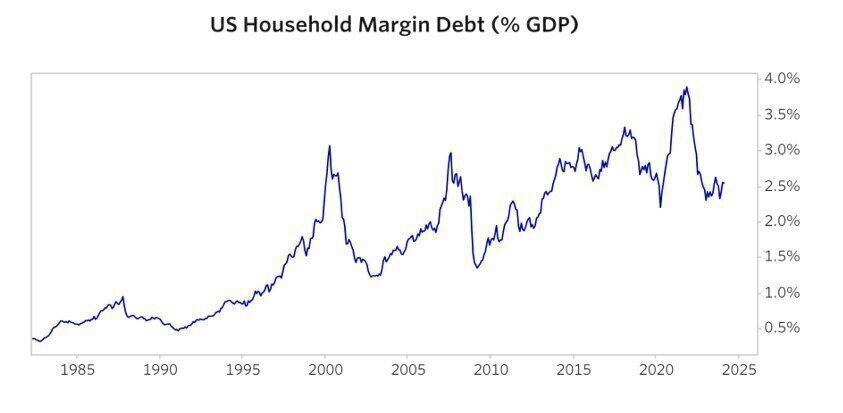

5. Are Purchases Being Financed by High Leverage?

Leveraged purchases make the underpinnings of the buying weaker and more vulnerable to forced selling in a downturn. Our leverage gauge, which looks at the leverage dynamics across all the key players, looks healthy—at around a 23rd percentile reading.

For example, you can see below that household margin debt outstanding has declined meaningfully from its COVID-era peak and is now near 10-year lows.

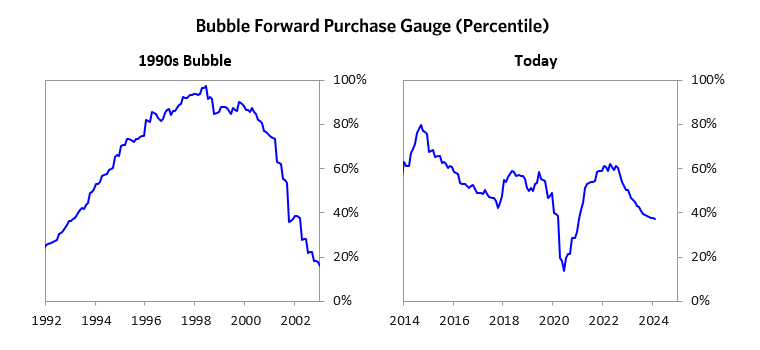

6. To What Extent Have Buyers Made Exceptionally Extended Forward Purchases?

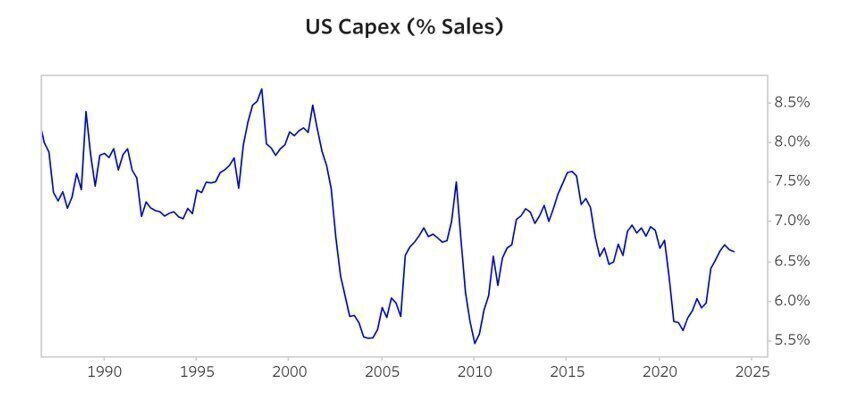

One perspective on whether expectations have become overly optimistic comes from looking at forward purchases. We apply this gauge to all markets and find it particularly helpful in commodity and real estate markets, where forward purchases are most clear. In the equity markets, we look at indicators like capital expenditures—whether businesses (and, to a lesser extent, the government) are investing a lot or a little in infrastructure, factories, etc. It reflects whether businesses are extrapolating current demand into strong demand growth going forward. This gauge is at the 38th percentile, a bit less bubbly than our other measures.

You can see below that levels of capital expenditure for listed US companies are still at relatively low levels.

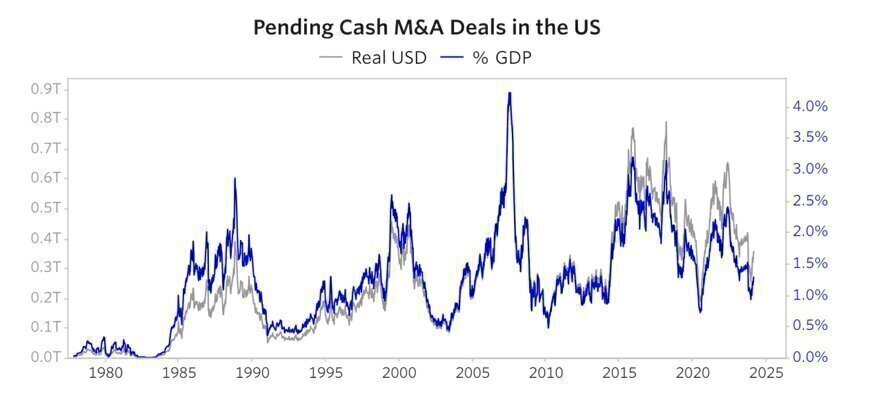

Pending M&A is another area where we can assess if buyers are making forward purchases of stock for cash. As you can see below, pending cash M&A deals are not particularly elevated today.

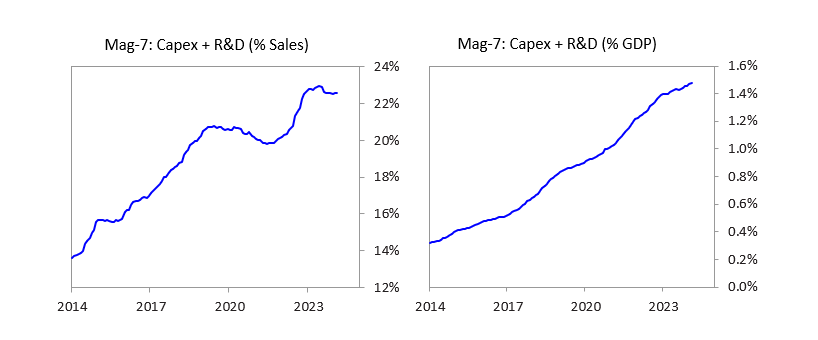

Forward purchases look frothy for the Mag-7. We see these companies investing significantly. You can see below that capex for these companies is at all-time highs, both versus their own sales and as a share of the economy.

We wanted to pass along our updated readings on our bubble measure to you in light of the large rally in US equities and questions I have gotten from readers. What you do with this is up to you.

For more finance and business tips, check our finance and entrepreneurship sections, subscribe to our weekly newsletter, and follow us on X, Facebook, Instagram, and LinkedIn.