Looking for the best trading platforms is not an easy endeavour and it does take some dedication and practice to find the right one.

Do you feel like starting investing, but lack the required knowledge and resources?

You don’t want your savings to stay passive in your bank account, but to work for a new car, education for your kids or your retirement?

Thanks to online brokers, investing has become more accessible and now everyone can become an investor starting with a couple of dollars.

Whether you want your money to work for your retirement or try your hand in a simulation with virtual cash, looking for a platform with great educational resources or the one helping you save as much on taxes as possible, keep reading.

We took a closer look at the most popular options currently available in the market in an attempt to find the best trading platforms available in the market, so that you could choose the most suitable broker for you.

📈 Here is an overview of the 27 best trading platforms, listed in alphabetical order.

Happy trading!

Acorns

Founded in 2012 in the US, Acorns is financial wellness investing app and a web platform, allowing you to invest in ETFs, set up a custodial investment account, and invest for retirement. It bases on micro-savings and micro-investing.

- Fees

Acorns charges a monthly fee of $1 – $5 depending on the chosen plan. There are no trade fees or minimum deposit.

- Features

Acorns offer a Robo-advisor model that provides advice and automatically invests client assets based on given information about the financial situation and future goals.

The Round-Ups feature saves your spare change rounded to the nearest dollar on every purchase with a linked account and adds the difference to your Acorns investment.

Ally Invest

Ally is the online brokerage of the US Ally Bank, having its roots in the TradeKing service, purchased and rebranded in 2016.

- Fees

With Ally Invest you can trade for free on eligible U.S. stocks, ETFs, funds and bonds. The platform charges an options-contract fee of $0.50. There is also a $50 transfer fee, $50 IRA transfer fee, and $25 IRA closing fee.

There is no minimum required to begin trading.

- Features

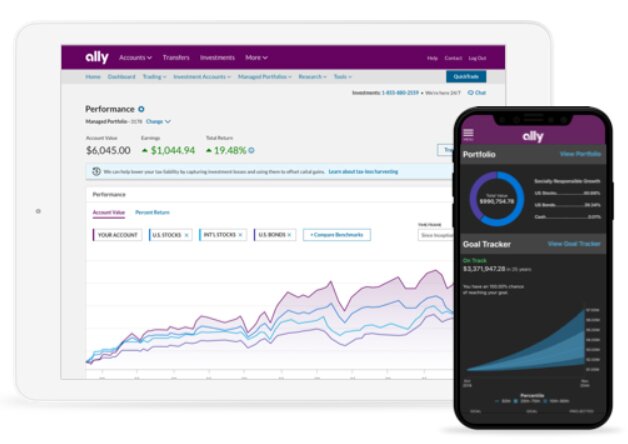

Ally offers an all-in-one mobile app, that connects all of your Ally accounts. Customer service is available 7 days a week.

You can take advantage of Cash-Enhanced Managed Portfolio, a function similar to a Robo-advisory service, aiming to assist you in building and maintaining your portfolio.

Betterment

Based in New York, Betterment was established in 2010 aiming to make investing simple. Based on a Robo-advisor model, the service automatically invests your money into low-cost ETFs.

- Fees

Betterment charges a fee of 0.25% per year (premium accounts are charged 0.40% a year). There is no minimum deposit and no withdrawal fee. Moreover, ATM fees worldwide are being reimbursed.

- Features

Betterments offers Tax Loss Harvesting, a program that works to offset taxes on both gains and income.

Capital.com

Capital.com is a London-based company founded in 2016. It is one of the largest CFD (Contract for Differences) brokers.

- Fees

The minimum deposit is 20€. There is no fee charged on trades, deposits, or withdrawals.

- Features

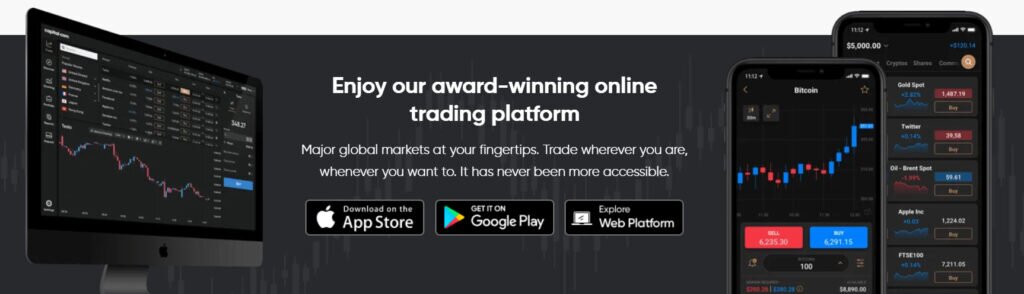

This AI-powered platform employed an AI trade bias detection system, Emotional Quotient (EQ) providing feedback and allowing you to understand your trading weaknesses.

Capital.com created the Investmate app, which allows you to learn about investing through engaging financial lessons, videos, quizzes, and more.

Capital.com is not available in the United States and Canada.

Charles Schwab

Founded in 1973 in the US, Charles Schwab provides brokerage and banking services.

- Fees

Charles Schwab offers commission-free ETF, stock, and options trades and does not impose an account minimum. There is a $0.65 fee per options contract.

- Features

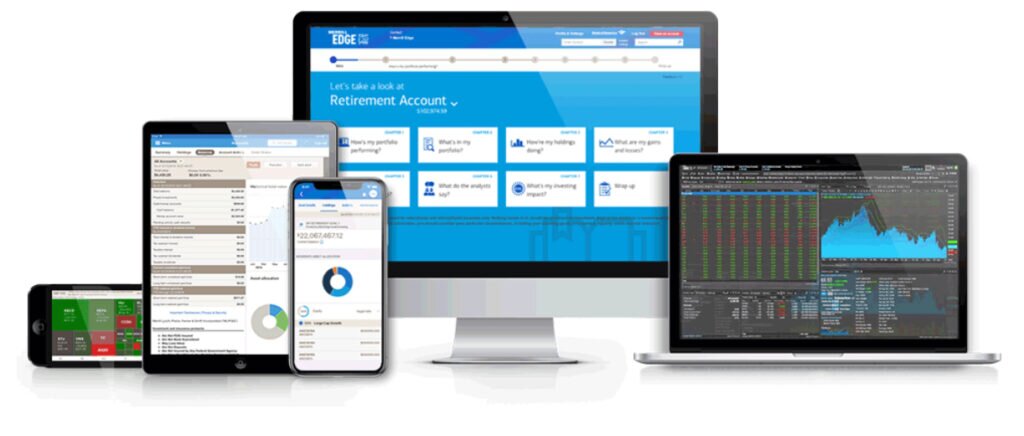

The company offers two trading platforms: entry-level Schwab.com web trader and more advanced StreetSmart Edge, with a customizable interface allowing you to adjust the trading process to your needs.

Customer service is available 24/7.

EasyMarkets

EasyMarkets was founded in 2001 with its headquarters in Cyprus. It provides multiple trading platforms and tools for first-time retail investors and more experienced brokers.

- Fees

You can start trading with a minimum deposit of 25$. EasyMarkets offers commission-free trading, with no deposit, and withdrawal fees. You can choose one of three account types depending on your investing style and goals.

- Features

EasyMarkets offers a variety of tools for beginner traders, such as free guaranteed stop-loss orders, insideViewer, dealCancellation, and Freeze Rate. Try out easyTrade and boost your investing skills with limited risk.

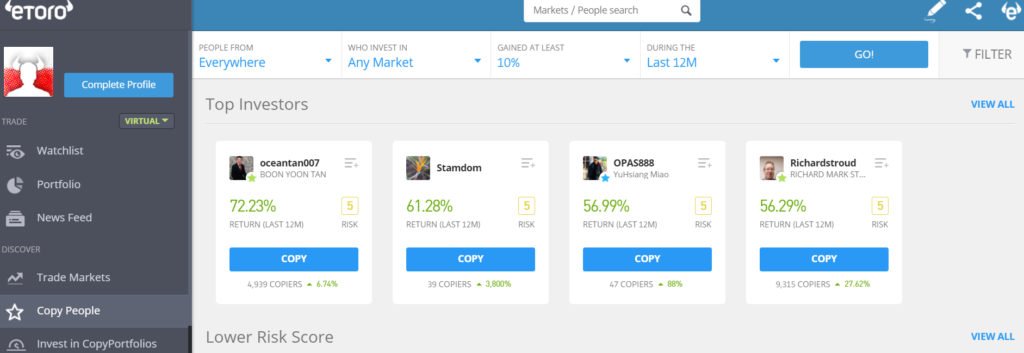

eToro

*eToro doesn’t serve the following countries: USA, Canada, Japan, Brazil, Turkey, North-Korea, Iran, Cuba, Sudan, Syria.

eToro is an Israeli company established in 2007. This web trading platform allows you to invest in currencies, crypto, commodities, indices, stocks, and ETFs.

- Fees

You can trade for free, however, eToro charges a 5$ fee on withdrawals as well as an inactivity fee. The minimum first-time deposit is 200$ (for Israeli residents the amount is $10,000).

- Features

If you don’t have time to run your in-depth market analysis, you may want to try a social trading feature, which allows you to follow and copy other, more experienced traders’ strategies.

E*TRADE

E*TRADE brokerage was founded in the United States in 1982. It allows you to trade in bonds, stocks, options, ETFs, mutual funds, futures, and target-date funds.

- Fees

The broker charges no commissions on ETF, online stock but there is a $0.65 fee per contract on options trades and $4,95 – $6,95 on OTC stocks. Customers are charged an additional $25 for broker-assisted trades. There’s no minimum account balance.

- Features

E*TRADE provides educational resources for beginner investors such as webinars and courses. For those who are not interested in making decisions themselves, there is E*TRADE Core Portfolios Robo-advisor service available (this feature charges a fee of 0.30% annually).

The customer service is available 24/7.

Ellevest

Founded in 2014, Ellevest is a company based in the US. Designed to help close the gender money gaps, this tool was built to meet women needs.

- Fees

Ellevest charges a monthly subscription fee of $1 – $9 (depending on a chosen plan).

- Features

Ellevest is a Robo-advisor that personalises and manages your portfolio to meet your financial goals.

Coaching and certified financial planner access are available at a discounted price that depends on the membership level you choose.

Fidelity Investments

Fidelity Investments is an American asset management company founded in 1946. It is only available for US citizens residing in the country.

- Fees

Fidelity charges no commission on ETF, stock and options trades and an option fee of $0.65 per contract. There is a fee to broker-assisted trades of $32,95.

- Features

Fidelity prides itself to be one of the best platforms for active traders. It offers easy fo navigate web-based platform and a mobile app and a more complex Active Trader Pro, offering extra features and advanced options fulfilling the needs of more experienced investors.

Interactive Brokers

Interactive Brokers was founded in 1977 in the United States to serve investors around the world.

- Fees

IBKR Lite doesn’t’ charge a fee on ETFs and stocks trades listed on US exchanges. IBKR Pro charges a $0.005 fee per share and between $1 and 1% of trade value with available discounts. Option trades charge a $0,65 fee per contract.

IBKR Pro accounts are charged a fee of $10 (accounts with less than $100k) or $20 (accounts with less than $2K) a month minus any trade commissions.

- Features

Interactive Brokers divides into IBKR Lite and IBKR Pro for more advanced traders. You can also take advantage of Interactive Advisors, a Robo-advisor charging a management fee between 0.08% – 1.5%.

IBKR offers a Tax Optimizer tool allowing you to optimize your capital gains and losses and full access to the features of Portfolio Analyst tool, which consolidates, tracks and analyzes your complete financial performance.

Thanks to a broad variety of tools and features, Interative Brokers is definitely among the best trading platforms available on the market today.

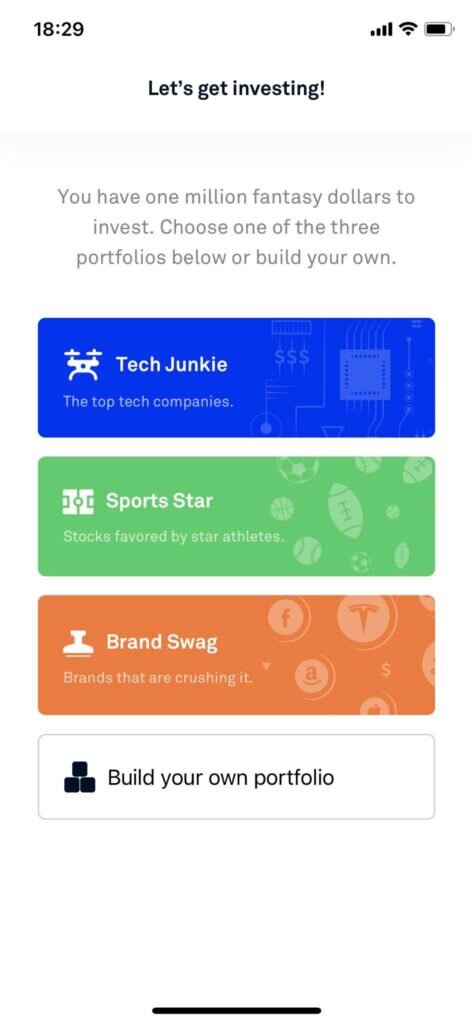

Invstr

Invstr is a fintech mobile app established in the UK in 2013 aiming to be a platform allowing you to learn about investing in a low-risk environment.

- Fees

You can download the app for free, but to start investing you need to register with the DriveWealth broker which charges a $5 fee.

There is a $2.99 fee per full trade and $0.99 fee per fractional trade.

- Features

Fantasy Finance, a virtual trading game will allow you to manage a virtual portfolio to boost your investing skills. Tackle challenges withing the game for the opportunity to win real money.

The app offers you an opportunity to learn more about finance by presenting you the daily podcasts from an expert team as a part of Invstr Academy.

Merrill Edge

Founded in 2010 in the United States, Merrill Edge is a discount brokerage service provided by Merrill Lynch. It doesn’t support cryptocurrencies, futures and futures options trading.

- Fees

The platform provides free stock and ETFs trades and a $0.65 option trade fee per contract. It also charges the mutual fund trade fee of $19.95 and a $29.95 commission for broker-assisted trades.

You can also choose one of Merrill Guided Investing advisory programs for a 0.45% or 0.85% annual fee and a minimum investment of $5,000 or $20,000.

- Features

Bank of America clients may qualify for a Preferred Rewards program and get additional benefits such as Merril Edge program fee discounts, interest rate boosts and more.

All clients of Merril Edge have an access to MarketPro streaming app, allowing you to arrange widgets and set up trading defaults on the website.

M1 Finance

M1 Finance is as a Robo-advisor platform based on a pie investing system using fractional shares. The company was founded in 2015 in the United States. It gives you access to stocks and ETFs, but you cannot invest in futures, mutual fund, options investing and forex.

- Fees

The basic account offers free ETFs and stock trades. M1 Plus Account charges an annual fee of $125 for additional benefits such as lower interest rates on margin loans.

- Features

There is a Tax Minimization feature available to all customers, opting for the most tax-favourable transactions. The brokerage doesn’t offer tax-loss harvesting.

You can take advantage of the articles and videos offered by M1 educational centre to learn more about finance and investing.

Personal Capital

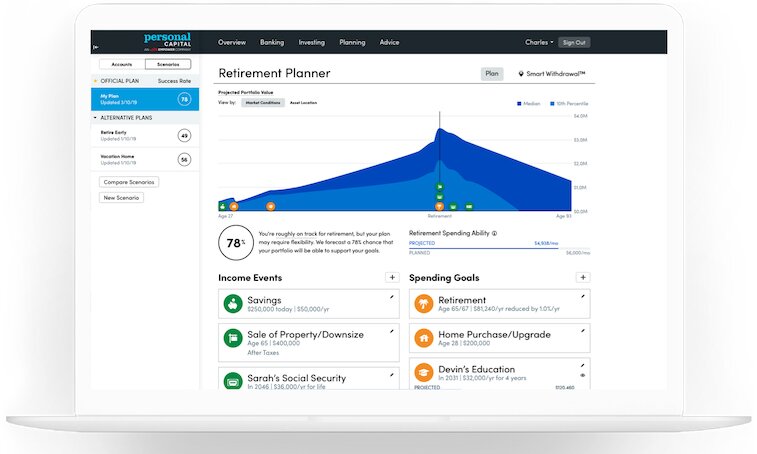

Founded in 2009 in the United States, Personal Capital is a digital asset management company targeting high-net-worth clients.

- Fees

There is a free planning tool available. However, taking advantage of Personal Capital’s wealth management services requires an account minimum of $100,000. It also charges a management fee of 0.49% – 0.89% (depending on your account balance).

- Features

Personal Capital has recently introduced the Recession Simulator, providing its users with insights into the effects of past market recessions.

The company offers its clients tax-efficient portfolios focusing on tax-sensitive asset location, employing tax-loss harvesting and tax efficiency.

To assess your portfolio, you can try out the Investment Checkup tool designed to minimize risk and maximize returns.

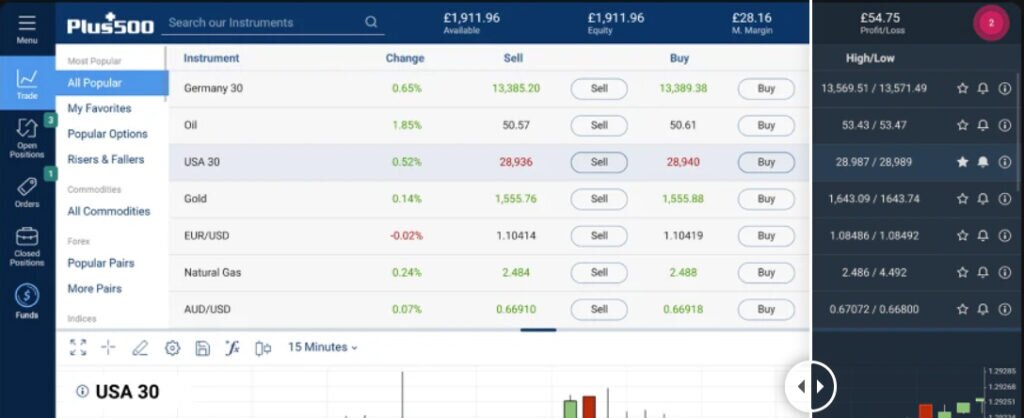

Plus500

This Israeli online trading platform was founded in 2008 as a CFD broker. It is not available for traders from the United States.

- Fees

Plus500 doesn’t charge trading fees. If there is no activity for three months, the broker charges a fee of $10. To open an account, you must deposit at least $100. There is a limit of 5 commission-free withdrawals a month.

- Features

This trading platform is very easy to use with a vast choice of tradable assets. It doesn’t offer any educational resources on finance and trading.

There is a Margin Call feature preventing your account from having a negative balance.

Robinhood

Robinhood is a brokerage founded in 2013 in the United States. It offers stocks, ETFs, cryptocurrencies, fractional shares and options trading.

- Fees

You can trade stocks, ETFs and options commission-free.

To trade margins, access research and market depth data, you must pay Robinhood Gold subscription between 5$-5% monthly.

- Features

You can trade fractional shares with as low as 1$ and there is no minimum required to trade cryptocurrencies, which makes Robinhood a good option for investors willing to trade small quantities and build a diversified portfolio.

Round

Round is a fintech company founded in the United States in 2016. It prides itself to be a Robo-advisor with an active approach.

- Fees

Round charges a 0.5% fee only if the monthly return is positive. In case of a negative return, the fee is waived. The minimum investment is $500.

- Features

Round builds up and adjust your portfolio to your needs. World-class fund managers combine sophisticated investments and look after your money.

SoFi Invest

SoFi is a finance company founded in 2011 in the United States. It targets young professionals offering them wealth management services adjusted to their needs. The brokerage is only available to residents of the United States.

- Fees

SoFi doesn’t charge trading fees and doesn’t require a minimum to start investing.

- Features

SoFi allows to trade stocks, ETFs, cryptocurrencies and fractional shares.

With SoFi, you can invest actively or take advantage of the Robo-advisor option and access the Certified Financial Planners.

Stash

Stash is a New York-based personal finance app founded in 2015. You can trade ETFs, stocks, fractional shares.

- Fees

You can open three types of account charging fees between $1-$9. There is no minimum required to start trading.

- Features

Stash offers help in building a portfolio as well as several educational resources allowing beginner investors to learn about trading.

Stock-Back program awards you fractional shares matching your purchases as well as bonus rewards for various actions.

Stockpile

The Stockpile was founded in 2010 in the United States aiming to be a platform for young people who want to learn about investing and get started trading stocks, fractional shares and ETFs.

To open a brokerage account, you must be a resident of the US.

- Fees

This online digital brokerage charges a fee of $0.99 on all trades.

- Features

Stockpile allows you to purchase gift cards redeemable for stock.

The brokerage also offers educational material explained in simple terms, so that the young and inexperience investors can easily understand.

Tastyworks

This US-based brokerage was founded in 2015 as a platform for options, futures, stocks and ETFs trading.

- Fees

You can trade stocks and ETFs for free. The brokerage charges a fee of $1 for stock options and $1,25 for futures options contracts opening among many others.

There is a minimum deposit of $2,000 on margin accounts and $0 on the cash account.

- Features

This advanced platform was designed for active, experienced brokers.

You can also take advantage of social trading service to copy other member’s trades.

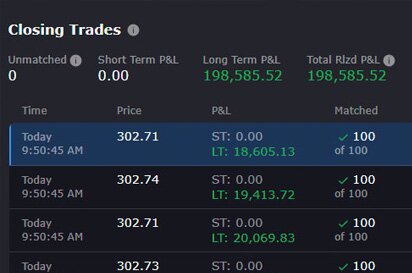

TD Ameritrade

Founded in 1975 in the US, TD Ameritrade is a company providing brokerage and financial services. The broker was acquired by Charles Schwab in October 2020.

https://www.youtube.com/watch?v=xQVH42vlPL8&ab_channel=TDAmeritrade

- Fees

The brokerage doesn’t charge fees on ETFs, stocks. There is $0,65 per contract fee on options trades. Broker-assisted trades cost $25.

- Features

TD Ameritrade offers its clients advanced routing technology and evaluates execution quality. The price improvement feature will allow you to save around $0.0262 per share.

You can trade using a web-based platform, mobile app, and a fully customizable thinkorswim Desktop platform. Try your hand and set up a practice account – paperMoney, and trade $100,000 virtual money risk-free.

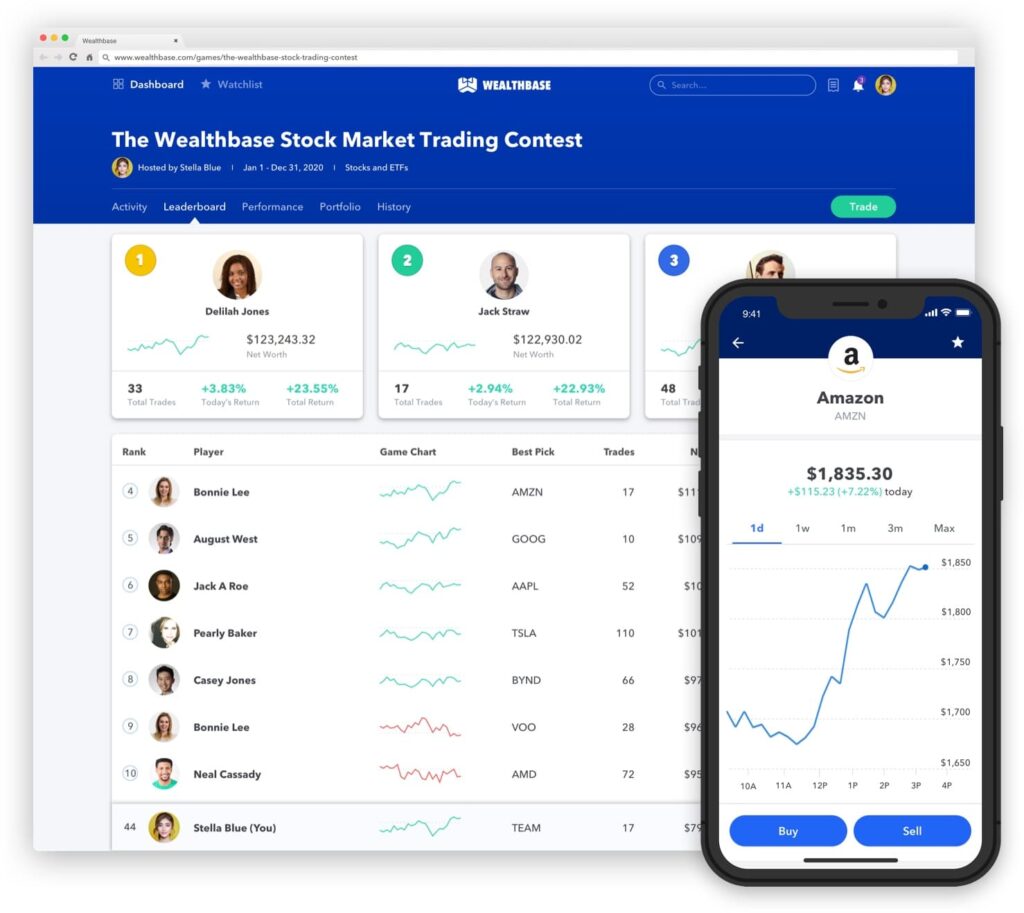

Wealthbase

Owned by Starburst Labs, Wealthbase is only available to residents of the US. It is not a brokerage, but a virtual simulation allowing you to learn and win prizes.

- Fees

You can register and play for free.

- Features

Once registered, you will be given a virtual $100,000 to create your virtual portfolio and trade stocks, ETFs, and cryptos. There are prizes to win (depending on the game).

Wealthbase Learning Center will provide you with educational resources about financial planning and investing.

Wealthfront

Wealthfront is an automated investing platform launched in 2011 in the United States.

- Fees

You have to deposit a minimum of $500. The platform charges a 0,25% fee a year.

- Features

Wealthfront is a Robo-advisor using the Modern Portfolio Theory (MPT) to create your portfolio, based on your financial needs and taking into consideration risk tolerance. It also applies a Path algorithm to provide you with financial advice and help you save money depending on your goals.

Wealthfront focuses on minimizing your taxes by offering Tax-Loss Harvesting, Intelligent Dividend Reinvesting, Tax Location, Index Funds, and Risk Parity features.

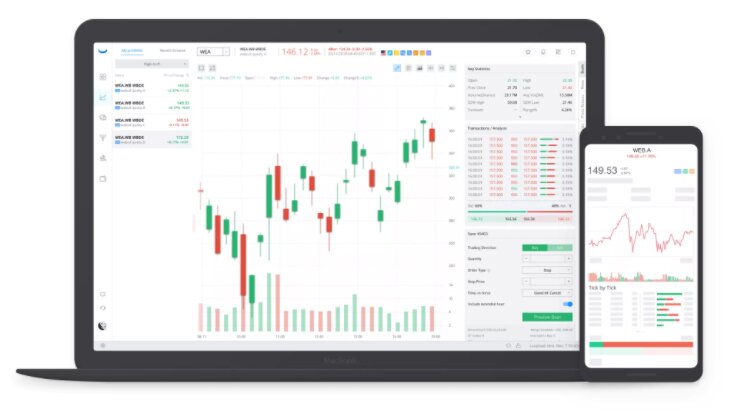

Webull

Webull is a financial company born in 2017 and based in China and the US.

You can only trade with this broker if you are a citizen of the countries above.

- Fees

The broker doesn’t charge commissions for trading stocks, ETFs, ADRs, and options.

- Features

Webull operates on a customizable, user-friendly platform and mobile app where you can invest in stocks, ETFs, and options.

With Webull, you can trade full pre-market (4 – 9:30 AM ET) and after-hours (4 – 8 PM ET) sessions.

Vanguard

Founded in 1975 in the United States, Vanguard is a client-owned investment company.

https://www.youtube.com/watch?list=PLZenmRYyxljb1B1WmZ3M3e5ER6gDm-tvn&v=U1fuQBc4KMU&feature=youtu.be&ab_channel=Vanguard

- Fees

There is a $20 annual account service fee, waived for the clients who’ve elected e-delivery of documents or have a required minimum of ETFs or assets.

You can trade stocks and ETFs commission-free. An option fee of $1 per contract is charged.

- Features

Users with $50,000 or more can take advantage of Vanguard Personal Advisor Services providing you with a financial plan based on your financial situation.

Vanguard Portfolio Watch will analyze your portfolio and compare it to the goals you have established to minimize risks. This tool will not only examine assets purchased with Vanguard but all of your holdings.

How do you like our overview of the best trading platforms? Which one is your favourite? Let us know in the comment section below!

For more finance and business tips, subscribe to our weekly newsletter and follow us on Twitter, Facebook, Instagram and LinkedIn.