Miracles do happen or so the herd seems to think at various times in history.

That’s why groupthink takes over, ‘liquidity’ momentum trades, regardless of value, call the shots and asset bubbles can be blown out of all proportion. Once you’re in such a phase, it feels like it could last forever. Nobody knows how long a ‘buying stampede’ can last, even if it is a rare one, which has already lasted twice as long as the typical one in history. As long as the primary trend is considered to be up, it may have years left to run! Riding the crest of a long wave is the fastest way to lose any perspective of what usually happens next. Every cycle turns eventually, for whatever reason, and it’s suddenly a whole new ball game.

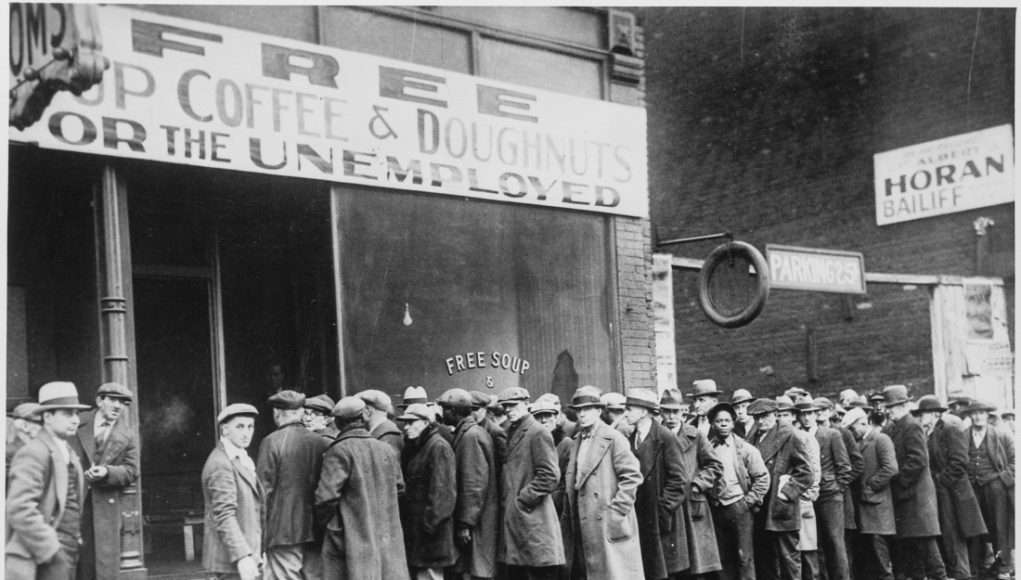

This whole new ball game is devastating for most.

Very few dare to stop playing, before disaster strikes. Most prefer to wait around and become sitting ducks. Whenever historic bubbles burst, with ensuing declines of 90% in a relatively short period of time, unthinkable hard times are bound to follow.

Those responsible for letting things getting out of hand, because they lacked the guts to put a stop to it, will have left the scene long before the ‘miracle’ turns into a nightmare. The dream of a ‘free lunch’ will again have dissipated.

The intended consequence of overly lax monetary policies, like Zero or even Negative Interest Rates plus Quantitative Easing (QE), is the destruction of savings. A sustainable economic model – the one that is meant to grow – has to be based upon a pool of savings, which has been painstakingly accumulated over time.

If it’s increasingly dependent on credit growth, then this growth model cannot survive, without an everexpanding level of credit to pay the interest on previously issued liabilities. Eventually, this model will hit the wall, because sufficient additional credit cannot be created, which is bound to lead to a capital shortage. Hard to believe, when liquidity today seems to be ‘abundant’!

We now live in very dangerous, unstable times, because unsound money and credit are dominating the global capital markets.

Policymakers have designed an artificial world to keep the show on the road, as the global economic growth cycle, for a variety of reasons, has experienced a secular slowdown since its peak 14 years ago, in 2000. But the next phase could well consist of global capital markets going into deep freeze, bank holidays, capital controls, some kind of Debt Jubilee and a collapse of world trade.

Markets will therefore tend to discount further real deleveraging, extended economic stagnation and a continued declining trend in both inflation and interest rates. This will be the death knell for credit-driven risk assets, like equities, commodities and real estate. Only quality fixed income holdings, particularly of core well-established government bonds, will weather this storm.

Most of the private sector, which lacks the taxing powers of governments, will suffer greatly.

That’s why an investment portfolio should emphasize a 60% Bonds/ 40% Stocks split for the next few decades, as the 60 year inflation and interest rate cycle reverses permanently and risk aversion becomes the name of the game. The notion, that yields of long-term Treasuries could rise 4%, leading to a negative total return of 40% ( but zero loss if held till maturity!), will have to be abandoned.

If that ever happened, it would be extremely short-lived anyway, because this heavily indebted world, as a percentage of GDP, cannot afford higher interest rates. Anybody, who believes in the ‘normalization’ of interest and growth rates, obviously refuses to accept, that the world has changed and that ‘the cult of the equity’ since the 1950’s and the 1960’s is over.

Needless to say, that expensive, illiquid alternative investments should be eliminated altogether, before it is too late.