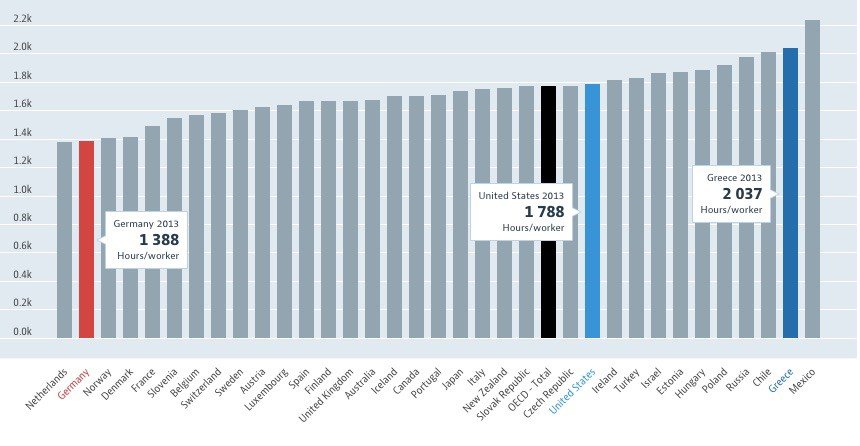

∑ Number of working hours per worker

Here is the catch: the Greeks don’t produce enough to cover their obligations.

Productivity is low because of a huge government administration: over 800 000 people work at the Greek government institutions. They retire only when they become 56 years old, and Greeks love to strike for better tomorrow – from 1998- 2008, they had 38 general strikes.

Another referendum took place almost 2 weeks ago. And 61, 31% Greeks said NO to proposals drafted by the European Union, the European Central Bank and the International Monetary Fund.

Well, Greece could leave the Eurozone, but it wouldn’t be too much impacted by that since only 2% of trade within the monetary bloc happened after the Greek economy got plugged in into the currency area. After all night Sunday celebrating, Greeks should work on how to get out of the debt. Greeks maybe made mistake with referendum, it was quick call based on emotions, maybe anger towards Germany for WW 2, and MMF debt slavery.

Options for Greece were:

- Introducing drachma again, this is logical choice but drachma would plummet, inflation would soar into the double digits. But after two years, Greece would have cheaper currency that would make export more competitive and tourism would be more attractive.

- Seek help from Russia, China or Turkey and take new loans, maybe sell some Greek assets to them. This is main concern in the EU, because Russia would spread influence on Greece, and it’s near EU.

- They must cut government administration, lift the bar for the retirement, and be more rational in terms of money spending.

This referendum sets a precedent for other debt-troubled countries such as Spain, Portugal, Italy to take referendums too and to try to sabotage out-smart the Troika creditors: International Monetary Fund, the European Central Bank and the European Commission.

UPDATE: The IMF made a statement on July 30 that it will not participate in the Greek rescue for now as “Athens’ high debt levels and poor record of implementing reforms disqualify Greece from a third IMF bailout”. This might present a problem as the German policy-markets might not approve the next EUR 86 bln tranche without IMF on-board. Meanwhile, Greece’s financial markets are going to re-open upcoming Monday.