Everyone wants to establish financial freedom before even finish college. But how can you do that?

4 tips to establish financial freedom while in college

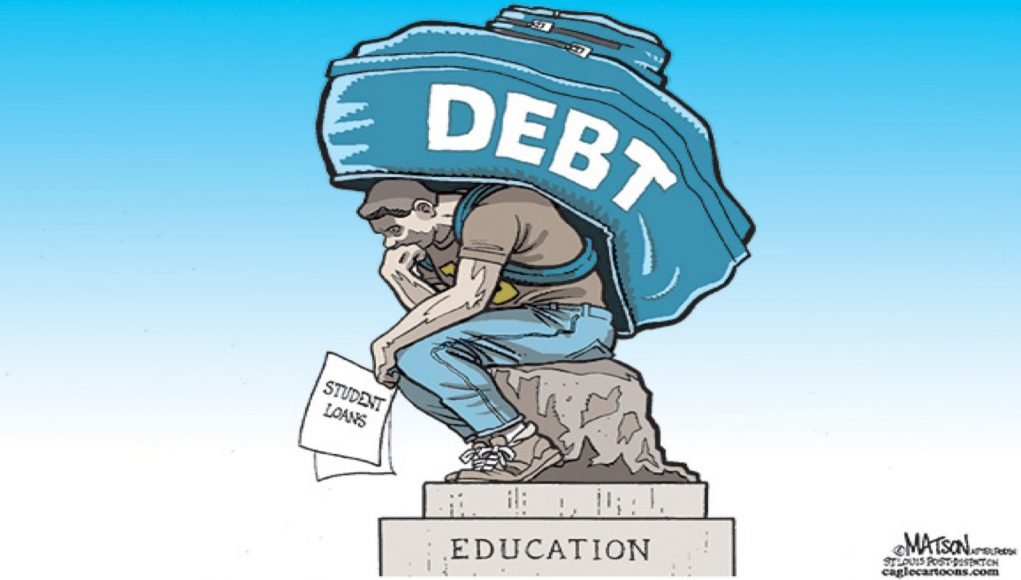

A lot of young people want to go to college. They see it as the pathway to greater income and opportunity. Sadly, it often becomes a financial chain that shackles them for the rest of their lives in a habit of excessive debt.

This is particularly true if you are considering going to school in the United States, where tuition per quarter or semester can range from $3,000-10,000.

This high cost puts a quality education out of reach of the pockets of normal people. The urge to compete encourages them to borrow excessively for degrees that may not be that lucrative.

Market excess is why after graduation we see many people flipping hamburgers with a B.A. degree.

This tragic fact is that even graduates who get well-paying jobs after college have already succumbed to credit addiction and find themselves with too many credit cards and an expensive mortgage payment.

If you do not want this to be you, try implementing the following tips from the billionaires in the world:

1. Buy low

Buying low is essential because it helps you cut expenses. Steve Jobs would not have made Apple one of the world’s largest companies if he had not outsourced manufacturing to Taiwan.

Labor prices are much cheaper and more skilled in Asian countries than in the United States.

Apple was then able to ship iPhones to the United States, greatly jacking up the price and getting an unearthly profit for their nifty trick.

One of the first steps toward financial freedom is to buy low

Make a list of the things that you absolutely need to live. Things like water, food, shelter, clothing, and transportation.

Everything else should be optional and only added on if you have the actual hard cash to pay for it.

When it comes to the essentials, try to think of things that your competitors in the market are afraid to consider when they are buying life essentials.

Attributes such as old, strange, embarrassing, expensive, dangerous, slow, and low-income. All of these things have few buyers.

They also have lower prices for market entry. Try buying low-income old shelter or slow embarrassing transportation.

You will find your expenses decreasing enormously, and your profits increasing enormously.

2. Sell high

Selling high is the market trick that takes advantage of humanity’s tendency to love itself.

We naturally tend to buy high. Why? We want the best in everything. The fool buys high and sells low. This leaves them greatly in debt to others.

The average person buys high and sells high. This leaves them stressed and barely breaking even. The billionaire buys low and sells high.

The billionaire buys low and sells high. This leaves them paying millions of employees and chuckling as they count the mounds of $100 bills that pour in every second.

To sell high, just think of the things that you naturally want to buy when you are not thinking clearly.

Things like pleasure, easy, fast, luxurious, comfort, safety, freedom, flattery, service, sweets, fats, meats, or entertainment.

Start selling these things like crazy. The ideal business model takes unpopular attributes and converts them into very popular attributes.

If you can practice this in your job searching and career preparation, it will help you immensely.

3. Pick a high-paying degree

Today, there is really no point of going to college unless you are picking highly demanded majors like science, technology, engineering, mathematics, health, law, or finance.

The other majors are more like expensive vacations. Understanding this principle will make sure that you do not finish your college career flipping burgers.

There are many people in college who really should be looking for a job. They end up picking the high school job after they graduate from college with $30,000 in debt. This is basically a recipe for financial ruin.

4. Chop up credit cards and other forms of debt

While extremely popular, credit cards are a loan. Buying stuff you cannot afford to impress people you do not like is simply silly.

Chop up your credit cards and resolve to live on hard cash, checks, and debit card. You will find that your financial behavior becomes far more moderate, and your wallet becomes flush with dollar bills.

When you see money flying away, it helps you spend it much less often. Do not be the typical U.S. citizen who passes on a mountain of debt to his family.

It sets a terrible example for the next generation. If you do not know how to chop up credit cards and begin paying off debts, try learning from an expert.

You might want to look into services that help people acquire financial freedom, such as Steve Down’s Financially Fit program.

How do you find the article? Have you already started planning for your financial freedom? Have you already tried any of the mentioned tips? Let me know in the comments section below.

For more finance and business tips, check our finance section and subscribe to our weekly newsletters.